Summary

- Over the past week, the protocol’s volume decreased by 9.18%, averaging $713.5M per day, compared to $785.6M on average in the three weeks prior.

- In the same span, SOL’s price decreased by 12.02%, ETH’s price decreased by 10.45%, and BTC’s price decreased by 4.13%. JLP decreased by 6.56% vs. the JLP basket’s 7.21%, representing an outperformance of 0.65% for LPs relative to the JLP pool’s underlying assets.

- Jupiter traders’ aggregate realized PnL decreased by $13.2M in gross terms and decreased by $21.7M in net terms due to their long-favored exposure. Traders’ cumulative unrealized PnLs, meanwhile, decreased by $50.8M this week.

Protocol Level

JLP Pool

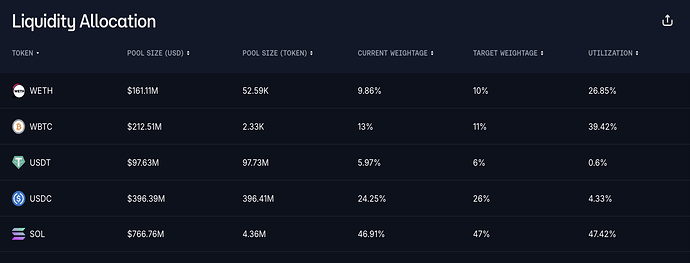

The JLP pool’s composition trended towards long tokens ahead of stables last week, with USDT and USDC deposits declining against WETH and SOL TVL growth.

The pool’s composition nonetheless hemmed fairly close to target. USDC trended slightly under and WBTC marginally above target.

JLP Market Comparison

JLP’s market price decreased by 6.56% over the last week. In the same period, BTC decreased by 4.13%, ETH decreased by 10.45%, and SOL decreased by 12.02%.

Given the JLP pool’s weights:

- SOL - 46.91%

- WBTC - 13%

- WETH - 9.86%

- USDC - 24.25%

- USDT - 5.97%

JLP’s basket price decreased by 7.21%, reflecting an outperformance of 0.65% for LPs due to the long-skewed imbalance of open interest & fees.

Volume

Volume decreased by 9.18% on Jupiter in the past week compared to previous weeks, averaging $713.5M per day, compared to $785.6M on average in the three weeks prior. BTC’s average daily volume decreased by 12.4% over the last week compared to the three weeks prior.

BTC and ETH continued to grow as a share of protocol volume - from 10-15% in past weeks to 15-25% last week.

Unique Daily Users

Daily active addresses oscillated between 3K and 9K in the last seven days. Activity remains elevated relative to its pre-presidential election average.

PnL

Due to Jupiter traders’ net long exposure, their aggregate realized PnL decreased by $13.2M in gross terms and decreased by $21.7M after accounting for fees. Traders’ cumulative unrealized PnLs, meanwhile, decreased by $50.8M this week.

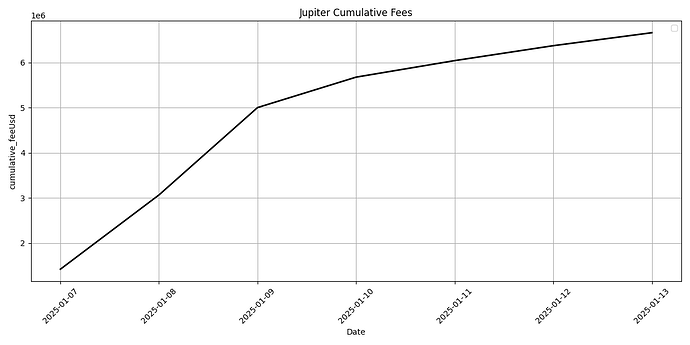

Fees

Over the past week, Jupiter’s cumulative fees were ~$6.7M, with a daily average of $951.5K, a decrease of 42.83% from $1.7M the previous three weeks.

Market Level

OI distribution

Jupiter’s traders continue to have a strong bias for long positions. There’s currently no expectation or reason for that to change.

SOL:

BTC:

ETH: